The most common charge and Snap Disqualification that our clients receive from the USDA are:

-

Transactions ending in the same amount ie. $4.88, $10.88

-

The Red Bull or Monster drink exchange from Sam’s Club

-

Transactions occurring within a short time period

-

Large transactions

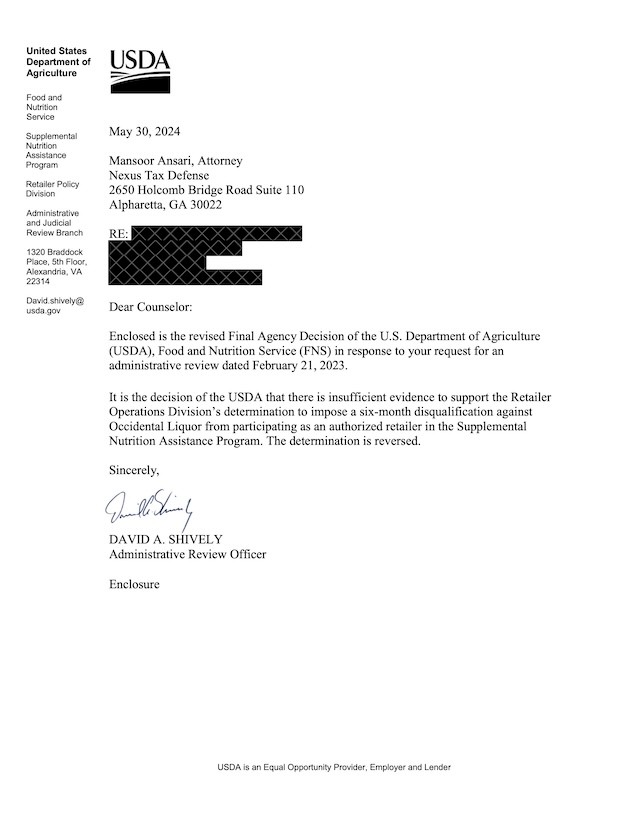

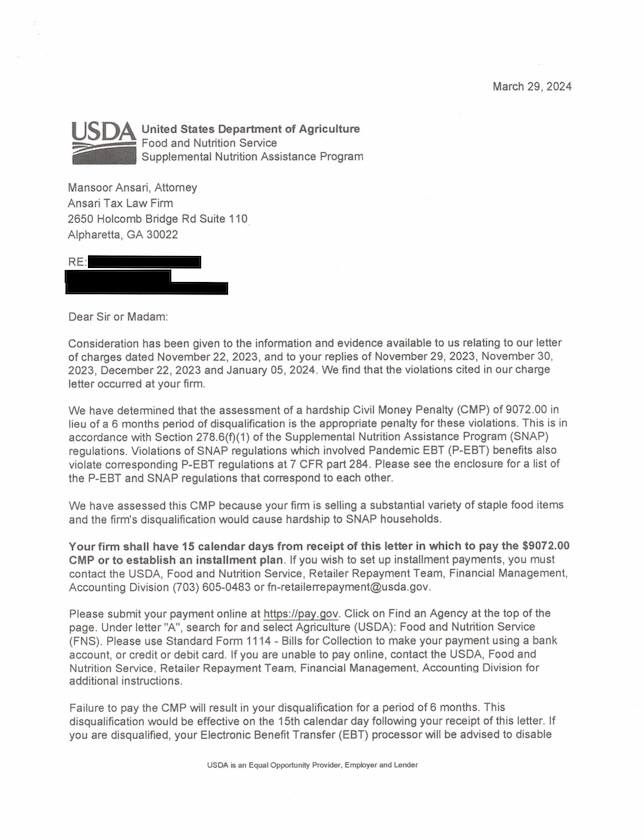

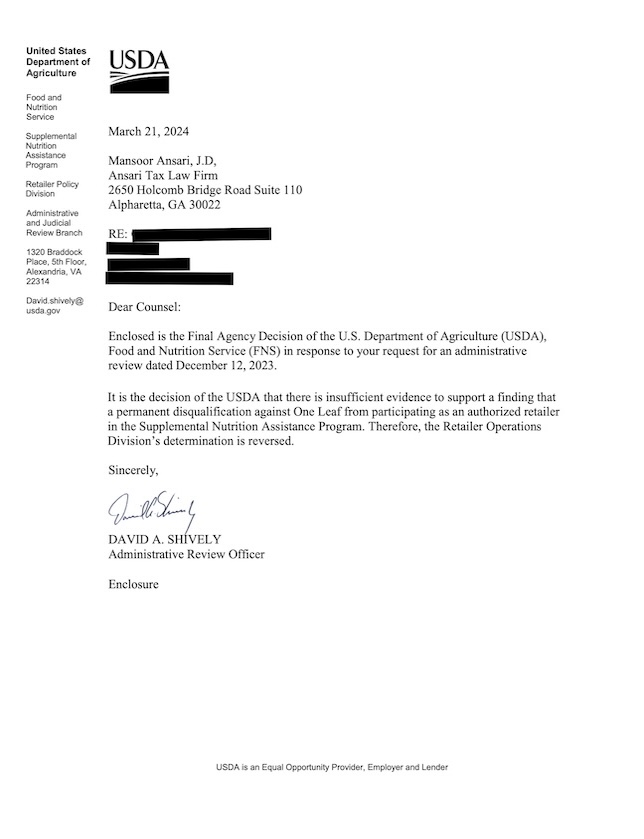

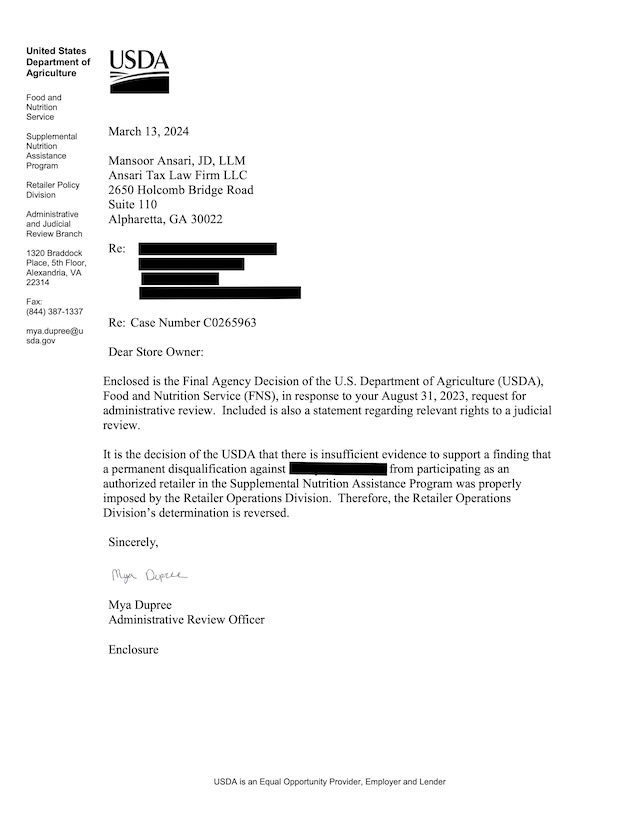

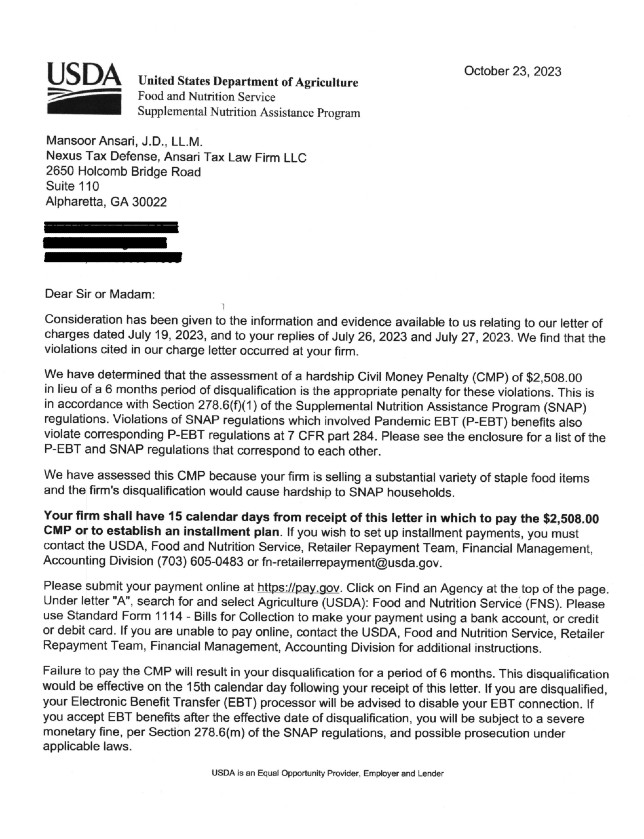

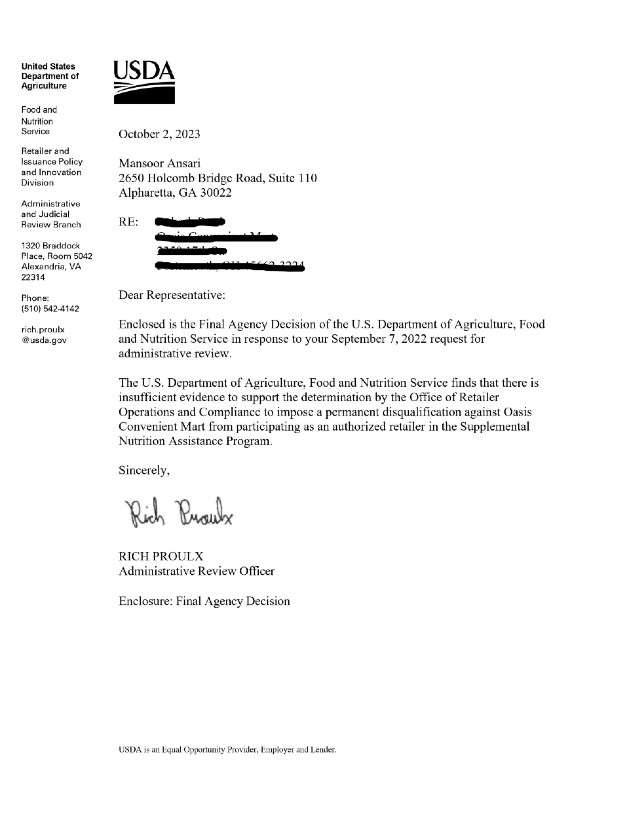

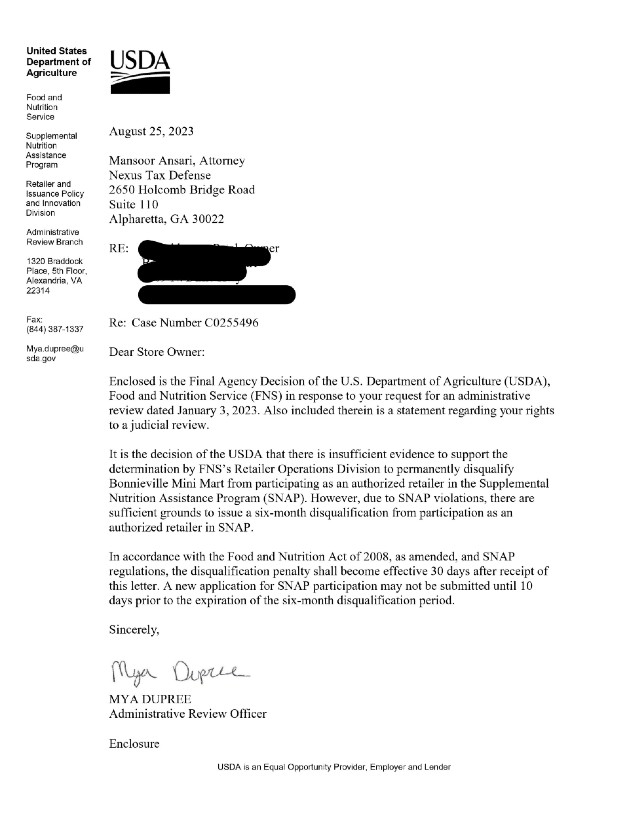

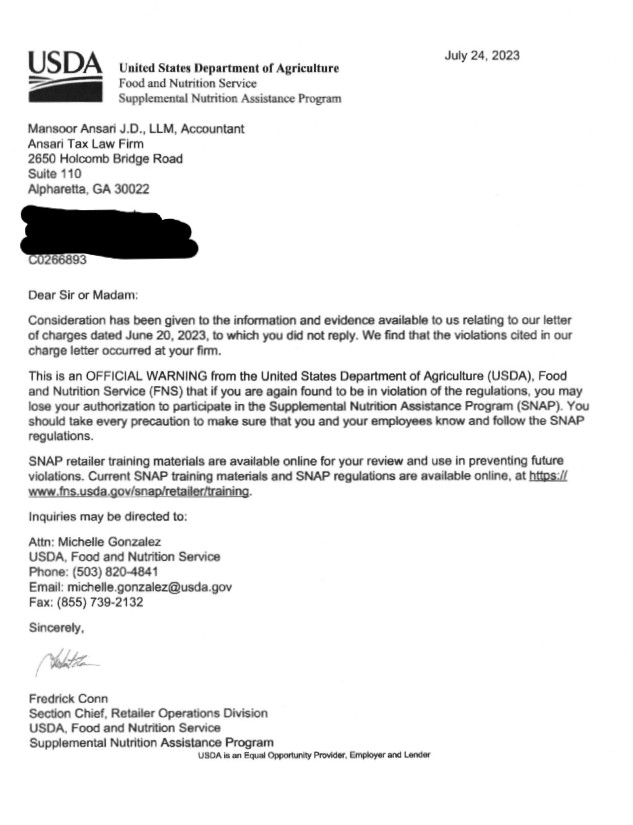

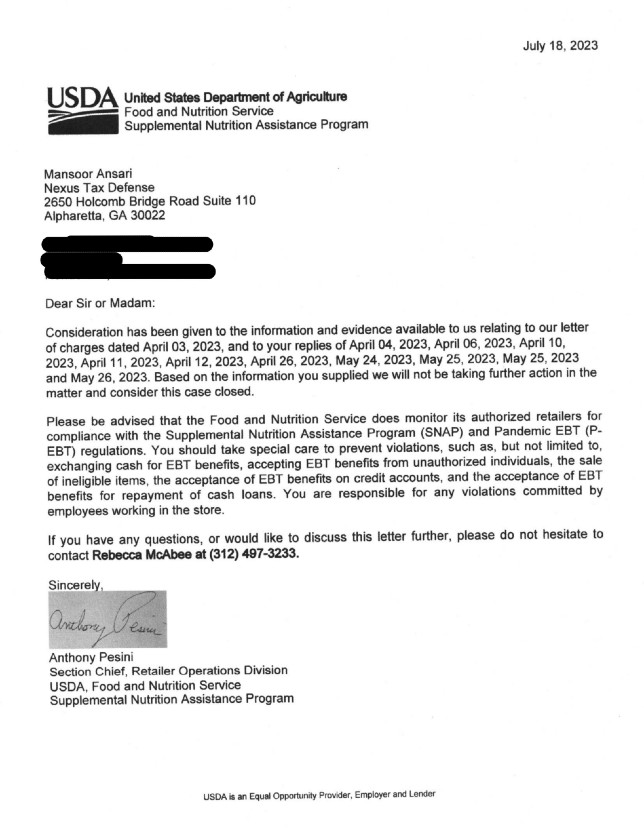

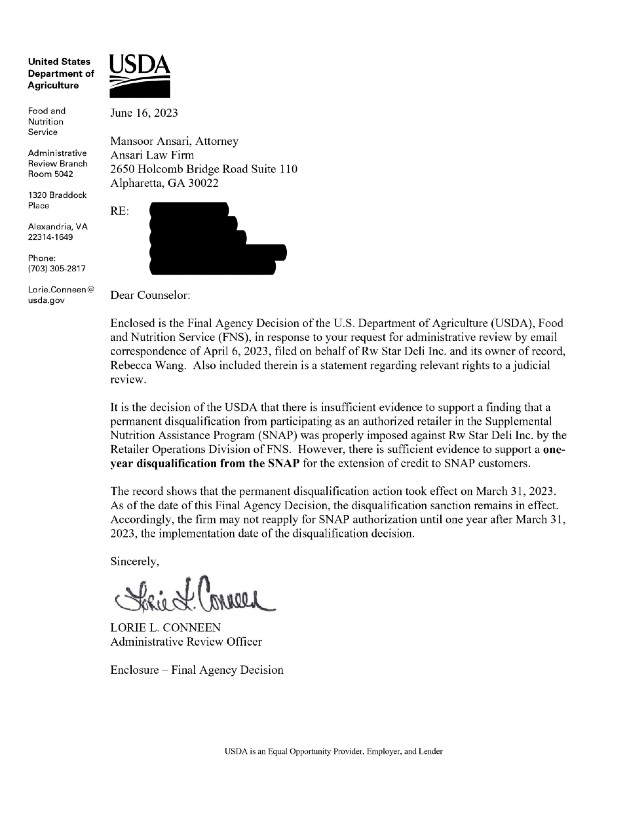

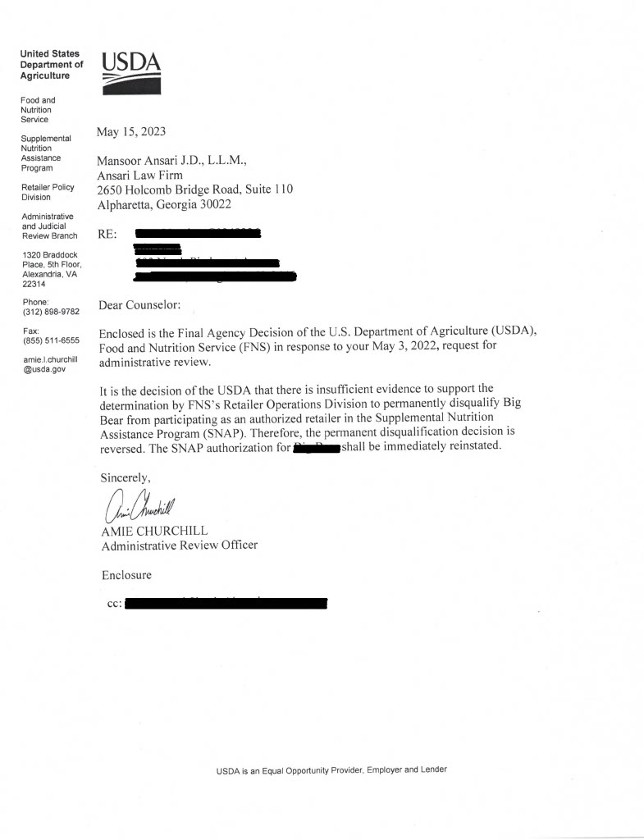

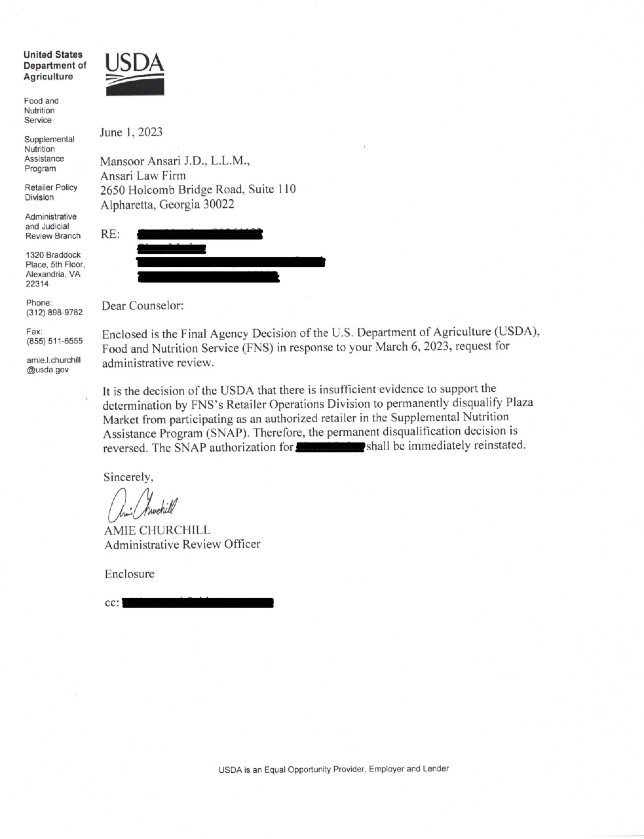

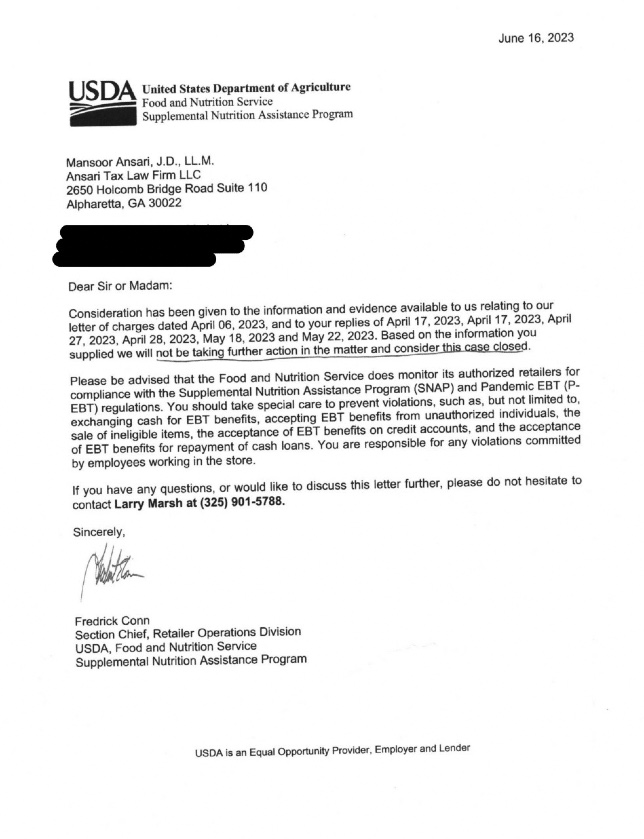

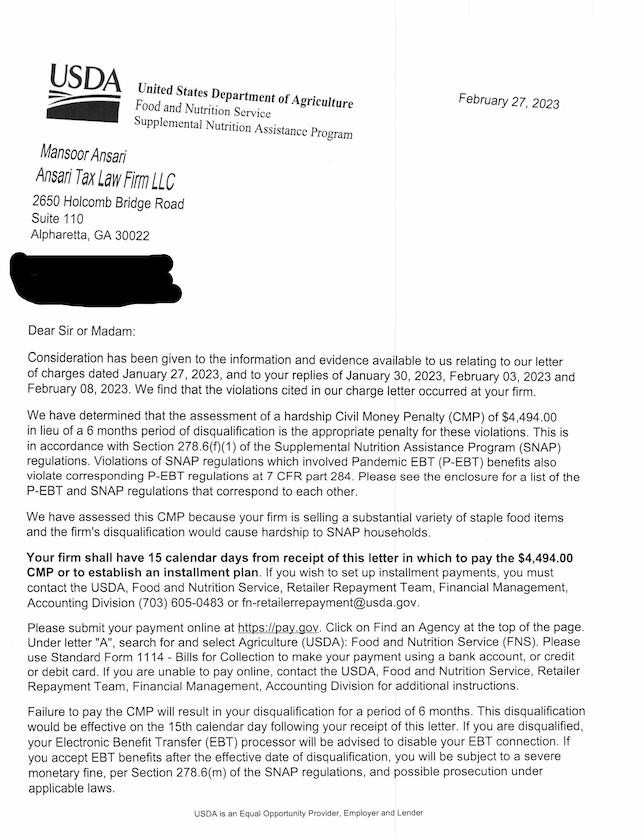

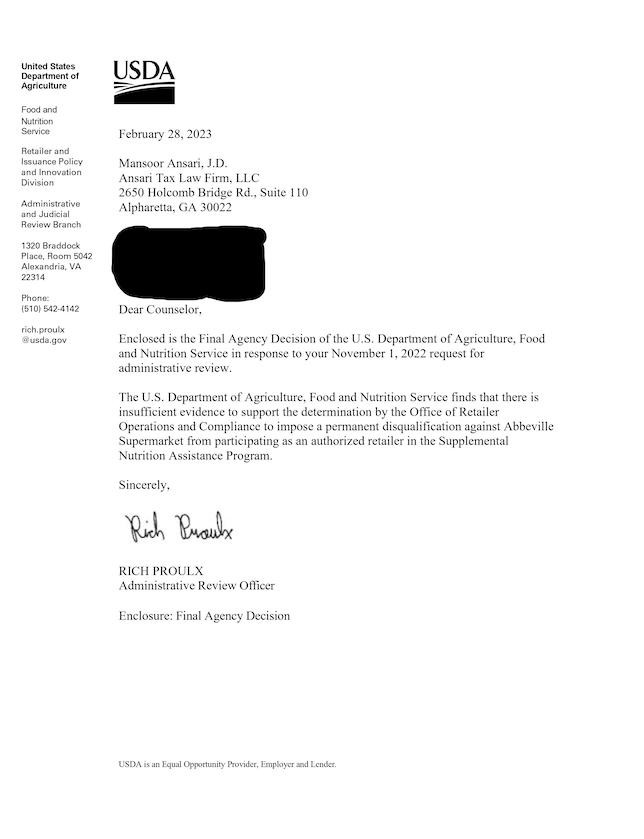

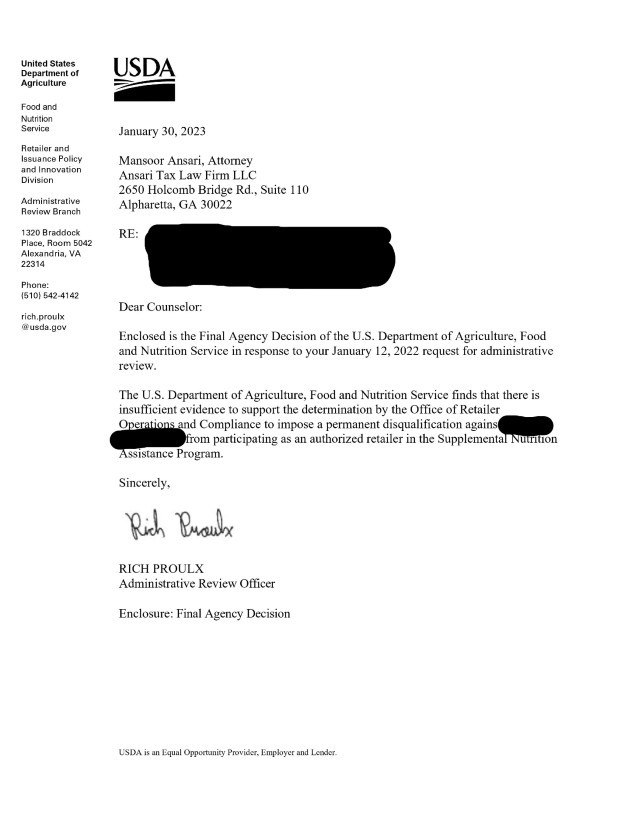

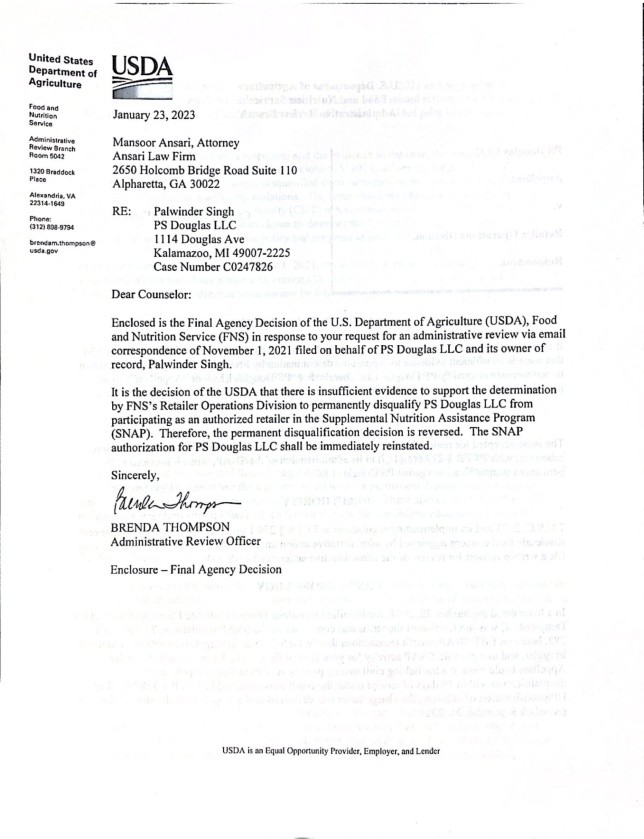

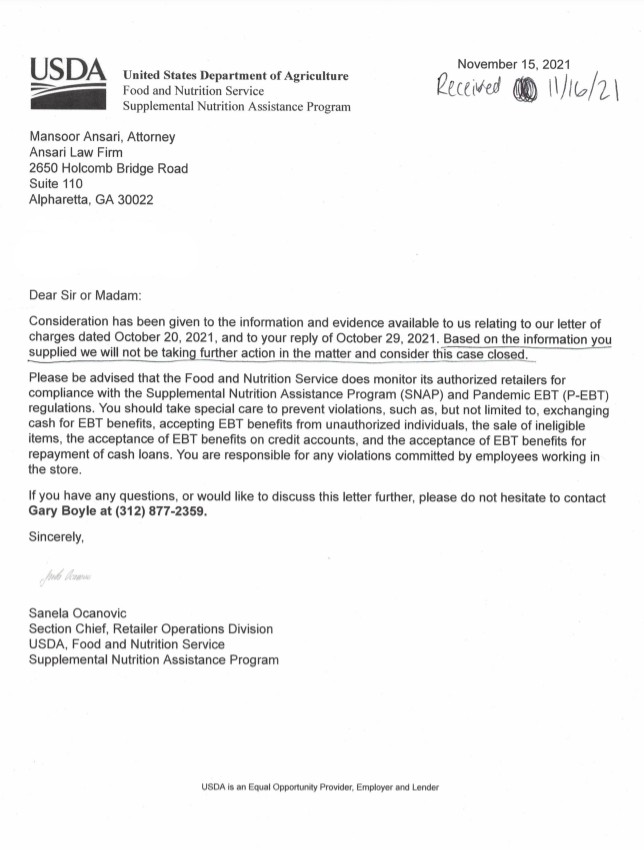

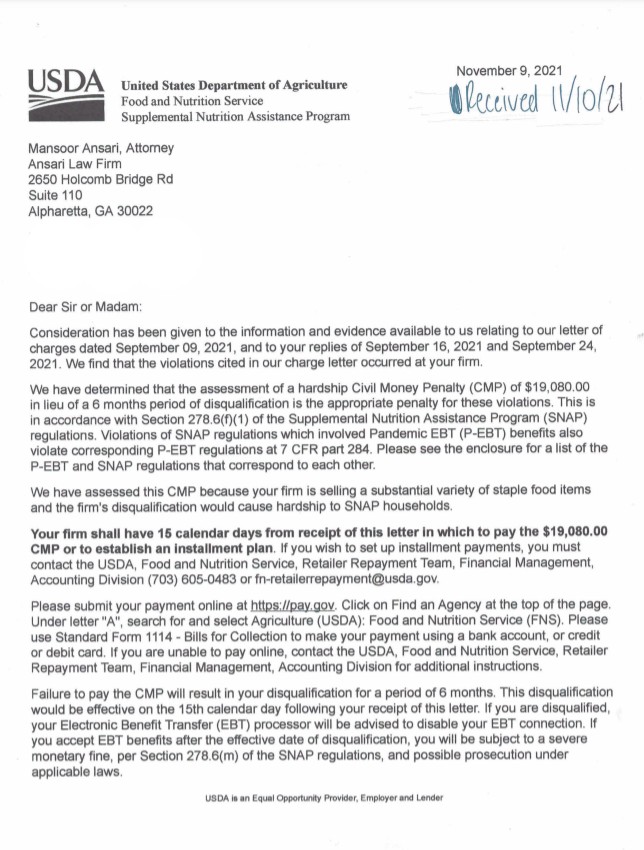

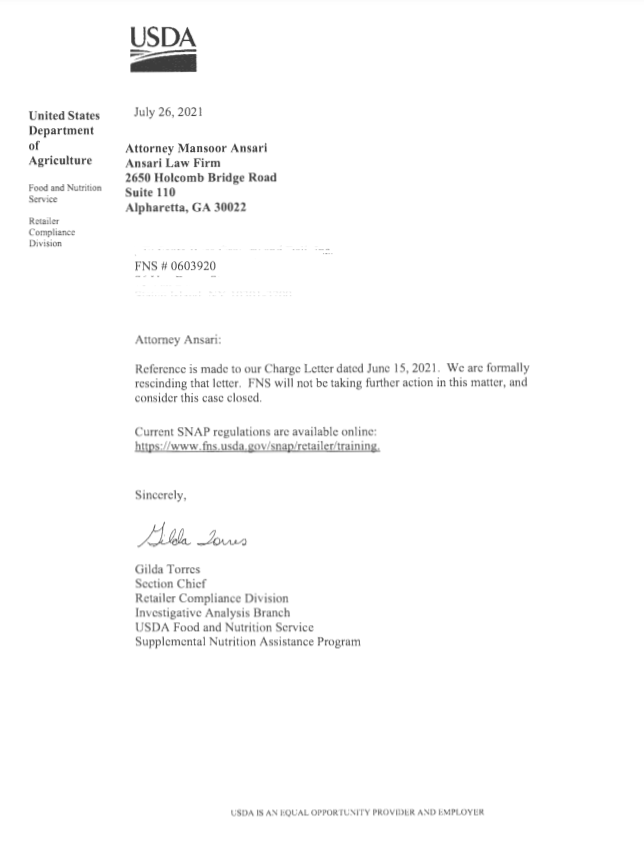

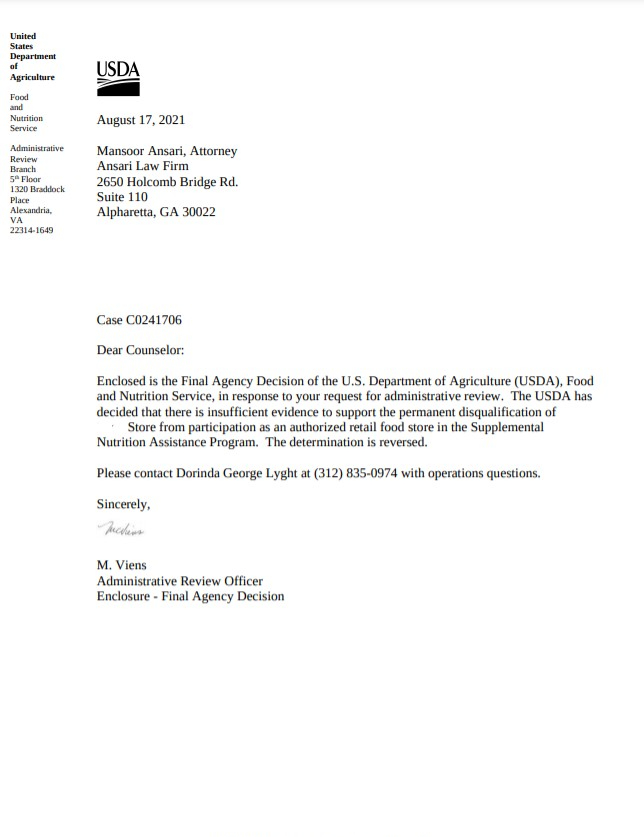

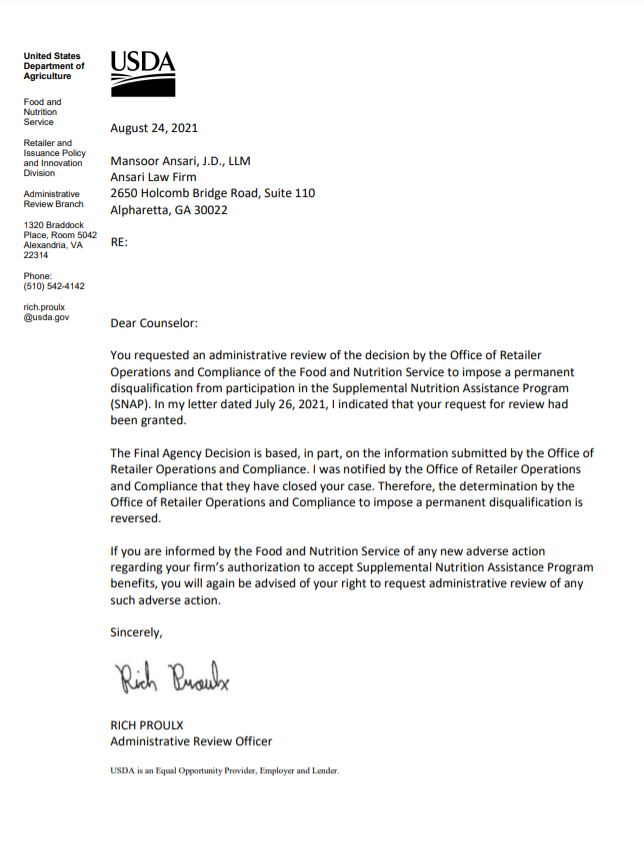

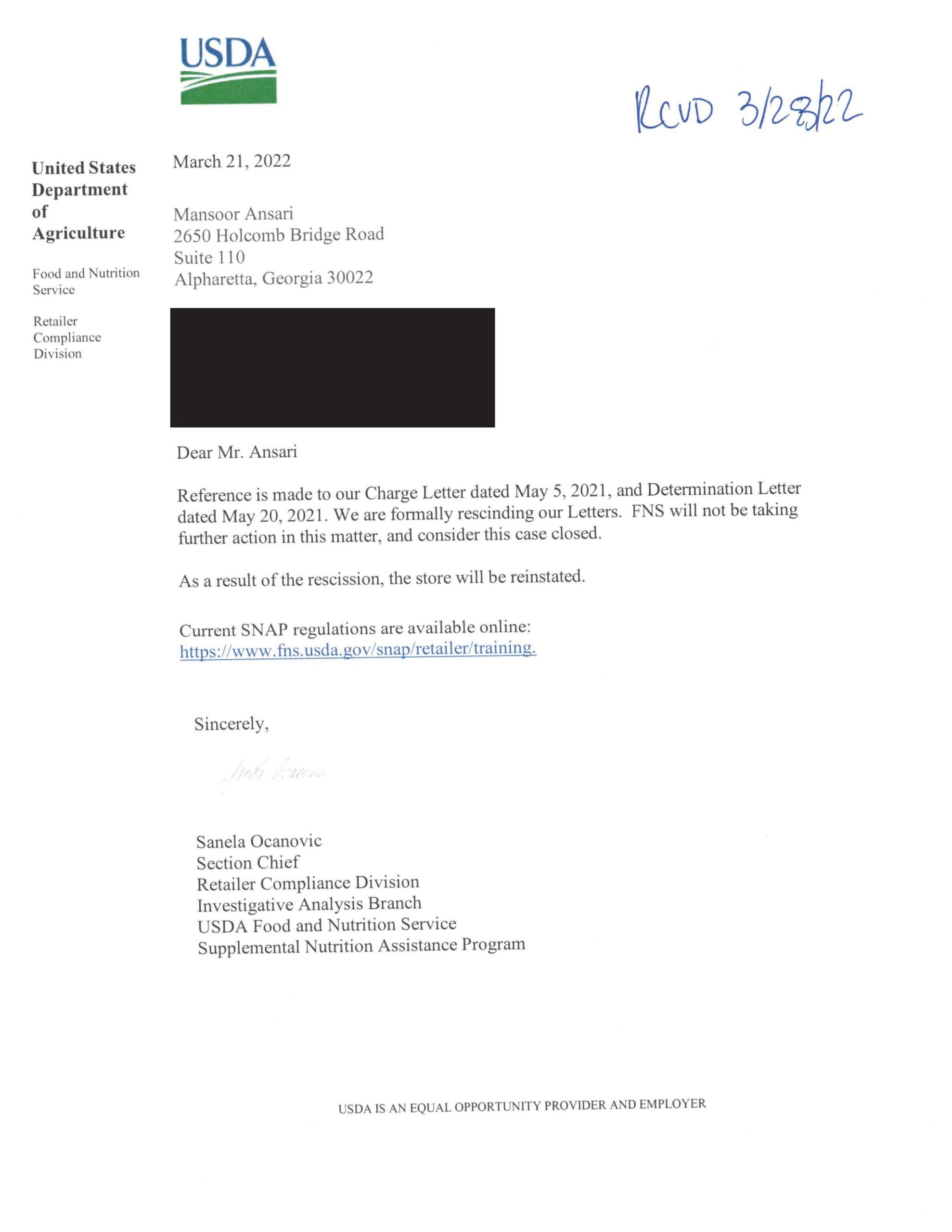

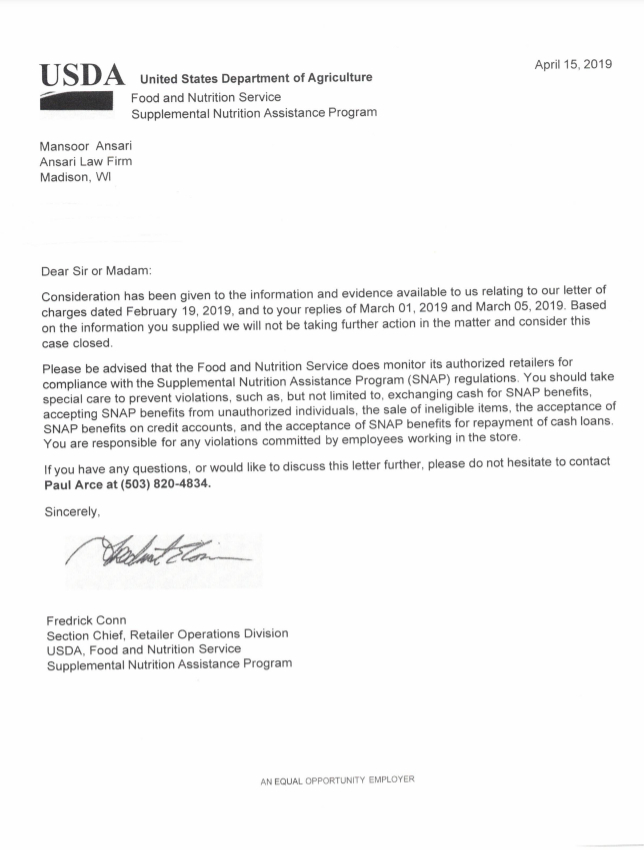

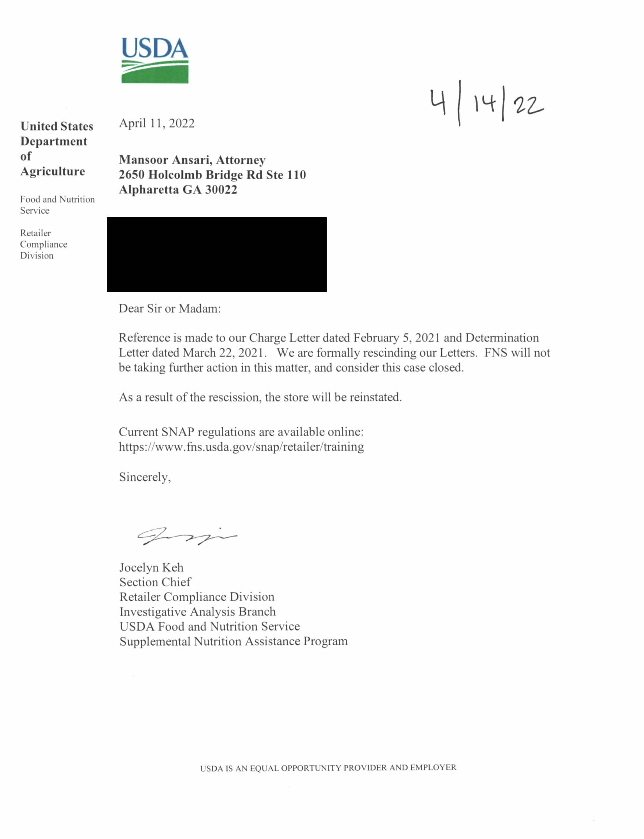

RECENT WINS BY OUR SNAP VIOLATION ATTORNEYS

Click on the PDFs:

SNAP Violation Lawyer Mansoor Ansari

If you are a store owner that has been charged by the USDA with SNAP trafficking of benefits, your first instinct might be that it was your employee and not you. I would think the same way had I not defended hundreds of SNAP violation cases.

As an attorney that deals with SNAP violations, I have seen employees selling ineligible items, majorly in eligible items, and sometimes even giving out cash in exchange for benefits. As a store owner, your job is to make sure that your employees are properly trained using the EBT machine in order to avoid suspension and or permanent disqualification.

Make sure to watch our videos on civil monetary penalties and SNAP violations. The tips on the videos are given to people who have either been cited for violations and or people that simply want to protect themselves in the future.

CMP: A civil monetary penalty is sometimes your only option. Unfortunately, after the violations have already been carried out, your best option may be to pay a penalty and move forward, if the USDA allows this to happen.

6 month suspension: losing six months worth of EBT customers could be devastating. Sometimes proving a hardship to the community might be a great option.

The ALERT System

The ALERT system analyzes millions of SNAP transactions and assigns ratings to businesses based on the number of unusual transactions they process. Unusual transactions can include sales volumes that are much higher than those at neighboring stores, multiple withdrawals from the same card over a short period of time, multiple purchases that end in the same number of cents, or very frequent or large purchases.

Most store owners have a practice of letting customers purchase food on credit — which results in one-time payments of hundreds of dollars when they clear their accounts — it up in the system as an atypical pattern and initiated his disqualification from the program.

THE USDA ARGUES that the ALERT system is one tool among many in a thorough disqualification process. “When [the USDA] suspects a store may be committing SNAP violations, staff will carefully review the store information including SNAP redemptions, any history of complaints, the owner’s history in the program, and store visit records which include photos and details of the store and inventory,” a USDA spokesperson wrote in an email statement. “If, after review of all the information gathered, [agency] staff believes further investigation is warranted, they (not the ALERT system) will initiate a compliance review — which may include further investigative analysis or an undercover investigation — and if warranted, charge the store with violations.”

However, the USDA section chief testified that the “investigative analysis” referenced in the agency’s emailed statement is based primarily on ALERT data. And there’s little leeway if a grocer is deemed to have violated the rules: According to decisionsOpens in a new tab posted to the agency’s own website, retailers can be disqualified with no prior violationsOpens in a new tab and decades of successful participationOpens in a new tab in the program.

Standard of proof: Preponderance of the evidence

This is a very flimsy standard of proof when you are wagering whether or not to disqualify somebody from the EBT program and essentially destroy their business. Essentially, if it is simply “more likely than not, that trafficking has occurred at the store,” then, you may be found guilty of trafficking.

Snap Trafficking

The most common charges that our clients receive from the USDA are:

- Transactions ending in the same amount ie. $4.88, $10.88. You need to ask yourself, can this logically happen?

- Manually entered transactions. How many of your customers have damaged cards? Are they present while this information is being entered?

- Transactions occurring within a short time period (within minutes or even seconds apart). Make sure to look for errors in the report such as transactions that seem to be close together in terms of time, but the dates are entirely different.

- Large transactions – are they really that large based on your store’s inventory? If you have a bodega and have transactions above $60.00 that is questionable. However, if you have a grocery store, then even $160.00 is a possibility.

Each one of these categories is discussed in greater detail in separate posts on our website. It is all too common that our clients will receive a 10-day notice, then, they will either themselves write a defense letter or get somebody not properly trained to respond to a USDA SNAP Trafficking charge letter and then come to us when their position is rejected. Obviously, as an Attorney dealing with SNAP and the USDA, we know that paying any Attorney legal fees for something out of the ordinary is something that most clients do not want to do. You will have to pay legal fees to our firm. However, you need to weigh the cost of having your EBT suspended indefinitely versus having things done the right way.

My employee did it, not me!

When you have violations at your store, the onus falls on the owner. Most of our clients tell us that it was not them who engaged in the violations, rather, it was their employee. This does not translate into a clear win, but it helps tremendously if it was not the owner.

In one of our cases, the store clerk, who is also an employee, was approached by a young and attractive woman. Said woman was an undercover USDA agent. The employee was trying to impress and create a relationship with this woman. At that point, he created a contract that the woman would purchase items on her EBT and then sell them to him at a lower price.

The employee was successful in creating the contract as well as getting his employer charged with trafficking SNAP benefits.

Overly aggressive USDA, undercover agents:

We have heard numerous stories of undercover agents, creating such a ruckus at the target store, but the store clerk has no other choice than to agree with an undercover agent in order to run their business.

The following court case deals with entrapment. Entrapment can be defined as an instance where the government agent seduces and induces an otherwise non-willing participant. But for this entrapment, the individual would have never engaged in the illegal activity.

SNAP-EBT training to avoid penalties

The Food and Nutrition Service (FNS) has sent out text messages reminding authorized users to stay up to date on proper SNAP-EBT training to avoid penalties. The texts went out Thursday, November 16, and will continue through today, Friday, November 17.

According to the website, “[FNS] expects Supplemental Nutrition Assistance Program (SNAP) authorized stores to have an established, operational compliance policy and program in place to prevent SNAP violations from occurring. Our goal is to ensure that all store owners fully understand and appreciate this responsibility and are aware of training resources.”

Adequate training includes:

A thorough review of FNS training materials and program rules

Documented initial training

Documented refresher training

Authorized users will receive the following text: “USDA: Make sure your staff is trained on SNAP-EBT rules. Learn more: fns.usda.gov/snap/retailer-reminder-training.”

SNAP customers are important to c-stores, and NACS is fighting for hot foods to be SNAP eligible items.

Americans relish the flexibility to purchase hot meals—such as a rotisserie chicken, soup or a hot sandwich—as they juggle multiple responsibilities. Americans who depend on SNAP need that type of flexibility as well. In fact, of the more than 42 million SNAP participants, approximately 70% are children, elderly or have disabilities. Removing the hot foods restriction is a commonsense update to modernize the program.

The Hot Foods Act (H.R. 3519) was introduced in the House with bipartisan support. NACS strongly supports the Hot Foods Act and removing the SNAP hot foods restriction in the upcoming Farm Bill.

Snap Trafficking Charges High Dollar Amounts

PAGE 7 OF THE SNAP MANUAL – RESPECT YOUR SNAP CUSTOMERS

Under this section, store owners are not allowed to restrict the time or purchase amount of its customers.

Is it not ironic that the SNAP manual written by the USDA tells you not to question your customers, but then they will send you a charge letter for having high-dollar sales?

Many of our clients sell large-dollar items such as raw meat, baby formula (Similac and Enfamil), and energy drinks at their stores. Now, couple that with large families such as in the West side of Chicago where you have a minimum of 4 kids per family and you now have a very high bill per customer.

The problem defending our clients starts when they cannot provide any documentation to support these claims. It is not a matter of obtaining sworn affidavits from customers, rather, it is a matter of producing your cost of goods purchased and matching them to z-tapes to support your claim that you have had to stock your store with expensive per item merchandise and that you actually sold that product.

Now, going back to page 7 of the SNAP Manual – Respect your SNAP customers – how is this possible when you have to make them legitimize their need for using their EBT card at your store to make a purchase? It is an impossibility to please the USDA and your client.

Administrative Appeals for USDA Snap Violations

Not responding to a letter is similar to that of any other default. You will get assessed in favor of the USDA and be responsible for the penalties and be disqualified from the program.

The difference between an initial charge response and an administrative review case is that in the latter, there will be more in terms of agency review as well as the length of time in closing a case. If you are already in an administrative review, you have probably already seen the response letter in the first case. It was most likely one and a half pages at most with boilerplate language. Did it sound like this: “Consideration has been given in your case. The USDA finds that it is more likely than not that trafficking has occurred at your store. Therefore you are being permanently disqualified from the EBT program.”

The outcome and/or judgment handed out in an administrative review case is anything but concise. The Agency analyzes each and every argument as well as the supporting documentation. They simply do not send a generic letter telling you that you lost.

Store credit – is this even legal? Actually, no.

Store credit is the most common issue giving rise to numerous transactions in a short period of time. Normally, a customer of our client will run a tab with the store when they run out of money on their EBT cards. The customer will wait until they get a replenishment of their benefits by the USDA, then, they return to our client’s store to clear their balance. It basically happens like this:

1. Customer runs a balance

2. Customer comes back to the store and goes shopping

3. Customer pays off their balance from the previous month

4. Within seconds the customer makes a new purchase.

For this reason, there are two transactions within a very short period of time that call into question whether or not our client is trafficking in benefits. While trying to appease your customers, you are running the risk of a permanent disqualification that comes with a $59,000.00 penalty. If you are giving store credit on EBT, you must stop doing this immediately.

Transactions ending in the same dollar amount?

We normally see charge letters that have transactions ending in .00 or .99. The question is why is this happening? Does it seem normal that customers would enter your store and have numerous charges ending in the same cent value? Ask yourself these questions.

We have heard from a lot of our clients, that their SNAP customers normally negotiate a deal on their groceries. A client of ours told us about a customer whom they nicknamed “$40 Rich.” $40 Rich would come into the store and only buy $40 to $45 worth of goods. He had already negotiated a price of $40.00 with our client, so his transactions would only end in the same dollar amount. If you see anything irregular, always remember to make some kind of note and be prepared to submit documentation to justify these types of transactions in case you get charged with trafficking SNAP benefits.

In another case, we had a client that was a Burmese refugee. He opened a small grocery store in his State that attracted individuals from 100 to 200 miles away. To make it worth their drive, he prepared ready-made boxes full of bread, candies, and other EBT-qualified items that are commonly purchased by people of Burmese descent. He sold each box for $55.00, which resulted in numerous transactions of $55.00 and $110.00 (when someone purchased two boxes at a time). Again, make sure to document large transactions and be prepared to produce z-tapes.

Are the transactions large based on the observed store characteristics?

Basically, the USDA is saying that your store looks too small to have such large sales. They will not take into account your storage space or even if you keep inventory off site.

Undercover agent investigation

The other SNAP violation letter is a collection of 3 to 4 instances where an undercover agent has solicited illegal favors from your store clerk. Each exhibit will show the ineligible EBT items that were sold or not sold. Here is the key:

M = Majorly ineligible item (non-food, non-household)

E = Eligible item (EBT qualified)

R = Refusal (your store clerk refused to sell the undercover agent this item)

F = Free (your store clerk gave away the item for free instead of committing a violation)

There is an explanation of the event with each instance of trafficking. For instance, the undercover agent will explain the conversation that they have with the store clerk. This conversation may be helpful. For instance, if your store clerk clearly states that “this is against the store policy.” Conversely, this conversation can be devastating to your case if the store clerk says “let me call my boss and ask them because they usually allow for this illegal activity at night.” Questions to ask here are:

- Was the store clerk the owner?

- Did the store owner authorize such activity?

- Was the store clerk trained?

- Was the store clerk coerced by the USDA’s agent?

10-day Notice

A charge letter, pursuant to 7 C.F.R. §278.6(b), sets forth the violations of SNAP the FNS alleges your firm committed and provides evidence supporting those allegations, such as Electronic Benefit Transfer (EBT) transaction records. A store is entitled to respond to these allegations within ten (10) days of receipt of the charge letter before the FNS can make a final determination. This ten-day period is crucial in the defense against a SNAP violation.

Is this 10 business days or 10 calendar days? Many of our clients erroneously believe that the 10 day notice does not include Holidays and/or weekends. The correct answer is that the deadline to respond with a properly drafted petition is within 10 calendar days. Again, calendar days is inclusive of weekends and Holidays. The only concession that you get is that if your due date falls on a Sunday, then, you can file your case the next day, on Monday, and it will be deemed timely filed.

Criteria for eligibility for a civil money penalty in lieu of permanent disqualification for trafficking. FNS may impose a civil money penalty in lieu of a permanent disqualification for trafficking as defined in § 271.2 if the firm timely submits to FNS substantial evidence which demonstrates that the firm had established and implemented an effective compliance policy and program to prevent violations of the Program. Firms assessed a CMP under this paragraph shall be subject to the applicable penalties included in § 278.6(e) (2) through (6) for the sale of ineligible items.

In determining the minimum standards of eligibility of a firm for a civil money penalty in lieu of a permanent disqualification for trafficking, the firm shall, at a minimum, establish by substantial evidence its fulfillment of each of the following criteria:

Criterion 1. The firm shall have developed an effective compliance policy as specified in § 278.6(i)(1); and

Criterion 2. The firm shall establish that both its compliance policy and program were in operation at the location where the violation(s) occurred prior to the occurrence of violations cited in the charge letter sent to the firm; and

Criterion 3. The firm had developed and instituted an effective personnel training program as specified in § 278.6(i)(2); and

Criterion 4. Firm ownership was not aware of, did not approve, did not benefit from, or was not in any way involved in the conduct or approval of trafficking violations; or it is only the first occasion in which a member of firm management was aware of, approved, benefited from, or was involved in the conduct of any trafficking violations by the firm. Upon the second occasion of trafficking involvement by any member of firm management uncovered during a subsequent investigation, a firm shall not be eligible for a civil money penalty in lieu of permanent disqualification. Notwithstanding the above provision, if trafficking violations consisted of the sale of firearms, ammunition, explosives or controlled substances, as defined in 21 U.S.C. § 802, and such trafficking was conducted by the ownership or management of the firm, the firm shall not be eligible for a civil money penalty in lieu of permanent disqualification. For purposes of this section, a person is considered to be part of firm management if that individual has substantial supervisory responsibilities with regard to directing the activities and work assignments of store employees. Such supervisory responsibilities shall include the authority to hire employees for the store or to terminate the employment of individuals working for the store.

FNS may impose a fine against any individual, sole proprietorship, partnership, corporation or other legal entity not approved by FNS to accept and redeem food coupons for any violation of the provisions of the Food and Nutrition Act of 2008 or the program regulations, including violations involving the acceptance of coupons.

Doing business with the USDA can be very profitable. Think about it this way – money is no longer an issue for your clients. How great would it be to simply have clients that can spend money at your business that have guaranteed payments. No chargebacks!

A very common phone call that we receive is “why did my application get denied?” We actually received a few phone calls from business owners who stated that the USDA contracts out local parties to survey their business prior to authorizing them with a license to conduct business with EBT / SNAP. The USDA has strict guidelines and we know how to adhere to them and help apply and in some cases reapply for a license with the USDA.

Why did I get rejected?

- You were previously permanently disqualified: If any one of your other business locations was charged with trafficking in SNAP benefits that resulted in a permanent disqualification, the individual holding that license cannot reapply or apply for another EBT license. The most common question that we get is “but the business was under another LLC or Corporation.” IT DOES NOT MATTER. Ultimately, it was tied to your social security number and identity, so applying for a new location is impossible.

- You are married to someone that was previously permanently disqualified: We had a case where a man was previously permanently disqualified in 2006. In 2012, he got married and then his wife applied for and EBT license in a business that she opened. Her application was denied because she was married to somebody that had already been permanently disqualified. Remember, this is a PERMANENT AND LIFETIME disqualification. The fact that she got married to the permanently disqualified individual after his disqualification makes no difference.

- You share the same household address as somebody that was permanently disqualified: When you apply for an EBT license and you list your home address as one that has belonged to somebody that was previously disqualified, then, the USDA will cross-check to see your affiliation with that person. There have been errors made by the USDA where they did not take into account a different unit or apartment number.

- You are a blood relative of somebody that was previously disqualified: How does this happen? If your father is permanently disqualified and then you go and apply for an EBT license, you will most likely be rejected if there is documented evidence that you in fact lived at his household. When your father filed his tax returns and listed you as a dependant, he submitted those tax returns to the USDA when he applied. For this reason, your information is already in their database.

- You have a felony conviction on your record: It’s plain and simple. Whether it’s as simple as possession of a controlled substance or a crime of moral turpitude, you will be denied. It may not even matter that your crime has since been expunged since the question on the application asks whether or not you have been convicted of a crime.

- MOST IMPORTANTLY, you did not complete the application properly. This is the most common problem that we see. Government applications are complex and cumbersome. Call our office at (888) 577-1482 if you need help with an application.

There may be other items that call for a rejection of an EBT application. This list consists of common issues that may arise and call for rejection.

Problems with reauthorization:

- One of the other businesses that you own was permanently disqualified.

- One of your business partners was permanently disqualified: How does the USDA know? They have a record of a K-1 that was issued to the permanently disqualified individual from your business income tax return.

Boosting Kids’ Access to Nutritious Food in Summer

During the Covid-19 Pandemic, the USDA increased the administration of benefits by a record amount. Our clients have told us many stories about their customers of how they would buy as much as they could given this new found wealth. Unfortunately, the P-EBT benefits have left many of our clients facing charges for the spike in their sales. Our clients have described their customers’ behavior such that they would buy as much as they could to spend every last dollar on their EBT cards. By law, our clients cannot ask why their customers are even purchasing said items.

(a) Overview. Section 1101 of the Families First Coronavirus Response Act (FFCRA; Pub. L. 116–127), as amended, authorized supplemental allotments to certain households. These benefits shall be referred to as Pandemic Electronic Benefits Transfer (P–EBT) benefits throughout this section. This section establishes the retailer integrity regulations for P–EBT for retailers in any State as defined in Section 3(r) of the Food and Nutrition Act.

(b) Definitions. For this section:

(1) Trafficking means the activities described in the definition of trafficking at § 271.2 of this chapter when such activities involve P–EBT benefits.

(2) Firm’s practice means the activities described in the definition of firm’s practice at § 271.2 of this chapter when such activities involve P–EBT benefits.

(3) Involving P–EBT benefits or involve P–EBT benefits means activities involving P–EBT benefits as well as supplemental nutrition assistance program (SNAP) benefits, or only P–EBT benefits.

(c) Participation of retail food stores and wholesale food concerns, and redemption of P–EBT benefits. Requirements and restrictions on the participation of retail food stores and wholesale food concerns and the redemption of coupons described at §§ 278.2, 278.3 and 278.4 of this chapter, including the acceptance of coupons for eligible food at authorized firms, also apply to activities involving P–EBT benefits.

(d) Firm eligibility standards. A firm may be subject to the following actions described at § 278.1 of this chapter for noncompliance or violations involving P–EBT benefits:

(1) The requirements described at § 278.1(b)(4) of this chapter regarding a collateral bond or irrevocable letter of credit for applicant firms with certain sanctions apply to applicant firms with sanctions imposed for violations involving P–EBT benefits. The amount of the collateral bond or irrevocable letter of credit shall be calculated in accordance with § 278.1(b)(4)(i)(D) and shall also include the amount of P–EBT benefit redemptions when calculating the average monthly benefit redemption volume.

(2) Authorization shall be denied or withdrawn based on a determination by the Food and Nutrition Service (FNS) that a firm lacks or fails to maintain necessary business integrity and reputation, in accordance with the standards and time periods described at § 278.1(b)(3), (k)(3), and (l)(1)(iv) of this chapter. When making such determinations, FNS shall consider the criteria referred to in § 278.1(b)(3), (k)(3), and (l)(1)(iv) where the underlying activities involve P–EBT benefits.

(3) Firm authorization shall be denied or withdrawn for failure to pay any claims, fines, or civil money penalties in the manner described at § 278.1(k)(7) and (l)(1)(v) and (vi) of this chapter where such sanctions were imposed for violations involving P–EBT benefits.

(e) Penalties. For firms that commit certain violations described at §§ 278.6 and 278.2 of this chapter where such violations involve P–EBT benefits, FNS shall take the corresponding action prescribed at § 278.6 or § 278.2 for that violation. For the purposes of assigning a period of disqualification, a warning letter shall not be considered to be a sanction. Specifically, FNS shall:

(1) Disqualify a firm permanently, as described at § 278.6(e)(1)(i) of this chapter, for trafficking, as defined at § 284.1(b)(1) of this chapter, or impose a civil money penalty in lieu of permanent disqualification, as described at § 278.6(i) of this chapter, where such compliance policy and program is designed to prevent violations of regulations of this section;

(2) Disqualify a firm permanently, as described at § 278.6(e)(1)(ii) of this chapter, for any violation involving P–EBT benefits committed by a firm that had already been sanctioned at least twice before under this section or part 278 of this chapter;

(3) Disqualify the firm for 5 years, as described at § 278.6(e)(2)(v) of this chapter, or for 3 years, as described at § 278.6(e)(3)(iv) of this chapter, for unauthorized acceptance violations involving P–EBT benefits, and impose fines, as described at § 278.6(m) of this chapter, for unauthorized acceptance violations involving P–EBT benefits;

(4) Disqualify the firm for 5 years in circumstances described at § 278.6(e)(2) of this chapter when the amount of redemptions, which shall also include the amount of P–EBT redemptions, exceed food sales for the same period of time, as described at § 278.6(e)(2)(ii), (iii), and (iv);

(5) Disqualify the firm for 3 years as described at § 278.6(e)(3)(ii) of this chapter for situations described at § 278.6(e)(2) of this chapter involving P–EBT benefits;

(6) Disqualify the firm for 1 year for credit account violations as described at §§ 278.6(e)(4)(ii) and 278.2(f) of this chapter, where such violations involve P–EBT benefits;

(7) Disqualify the firm for ineligibles violations for such circumstances and corresponding time periods as described at § 278.6(e)(2)(i), (e)(3)(i), (e)(4)(i), and (e)(5) of this chapter, where such violations involve P–EBT benefits;

(8) Double the appropriate period of disqualification for a violation, as described at § 278.6(e)(6) of this chapter, where such violation involves P–EBT benefits, when the firm has once before been assigned a sanction under this section or part 278 of this chapter;

(9) Issue a warning letter to the violative firm when violations are too limited to warrant a period of disqualification, as described at § 278.6(e)(7) of this chapter, where such violations involve P–EBT benefits;

(10) Impose a civil money penalty for hardship or transfer of ownership, as described at § 278.6(g) of this chapter, in amounts calculated using the described formula at § 278.6(g), which shall also include the relevant amount of P–EBT redemptions when calculating the average monthly benefit redemptions; and

(11) Impose a civil money penalty in lieu of permanent disqualification for trafficking as described at § 278.6(j) of this chapter in an amount calculated using the described formula at § 278.6(j), which shall also include the relevant amount of P–EBT redemptions when calculating the average monthly benefit redemptions.

SNAP benefits increase as eligibility requirements change through 2024

Millions of Americans rely on the Supplemental Nutrition Assistance Program, or SNAP, for benefits to supplement their grocery budget to afford nutritious foods. As of Oct. 1, the program received a much-needed boost to help meet the increased cost of living and inflation. The program, overseen by the USDA Food and Nutrition Service arm in accordance with the Food and Nutrition Act of 2008, adjusted the maximum allotments starting this month for the year ahead, based on the Consumer Price Index from the Bureau of Labor Statistics for June 2022.

One group specifically, able-bodied adults without dependents between ages 51-52 — labeled as ABAWDs by the agency — will now need to prove they are actively working, training or in school in order to qualify for SNAP benefits.

Work requirements expanded up to age 52 starting Oct. 1. Requirements will expand to age 54 starting in October 2024. Starting this month, SNAP benefits are increasing by 12.5% compared to last year, as reported by Forbes Advisor. According to the cost of living adjustments (COLA) for 2024, maximum allotments have increased at various increments for the 48 contiguous states and the District of Columbia, Alaska, Guam and the U.S. Virgin Islands. A family of four in the continental U.S. and Washington, D.C., will now be allowed a maximum of $973. Maximum allotments for a family of four in Alaska would range from $1,248 to $1,937; in Guam it would be $1,434 and in the U.S. Virgin Islands, $1,251. The only location with a decreased maximum allotment is in Hawaii, where a family of four would now see a maximum payment of $1,759. Additionally, the shelter cap value has increased to $672 for the 48 contiguous states and D.C.

To meet net monthly income eligibility standards, your income must be no more than equal to the U.S. poverty level. For gross monthly income eligibility standards, your income must be no more than 130% of the poverty level. The highest income levels for fiscal year 2023 went into effect on Oct. 1, 2022.

SNAP is a federal program that provides food-purchasing assistance to low-income households. Although it is part of the U.S. Department of Agriculture, the program is administered at the state level. Recipients are now issued Electronic Benefits Transfer (EBT) cards to pay for food rather than physical food stamps.

In an August memorandum, the USDA said that maximum SNAP allotments will increase for the 48 states and the District of Columbia, Hawaii, Guam, the U.S. Virgin Islands and Alaska. For a family of four receiving a maximum allotment in the 48 states and D.C., benefits will be $939. Maximum allotments for a family of four will increase to a range of $1,172 to $1,819 in Alaska; to $1,794 in Hawaii; to $1,385 in Guam; and to $1,208 in the U.S. Virgin Islands. The minimum benefit for the 48 states and D.C. will increase to $23 and will also increase in Alaska, Guam, Hawaii and the U.S. Virgin Islands.

Make sure to contact an attorney that deals with SNAP violations.

New York, California, Georgia, Texas, Pennsylvania, Illinois, New Jersey, North Carolina, and Florida commonly see the most SNAP violations. The plain and simple reason is that they have the most stores. More stores and more people equal more transactions.

Snap Violations

An Intentional Program Violation (IPV) is any action taken by a client for the purpose of establishing or maintaining SNAP eligibility or for increasing or preventing a reduction in the benefit amount which is committed knowingly, willfully, and/or with deceitful intent…

Read About Snap Violations

10-day Notice

At some point, the USDA started monitoring your business for SNAP Trafficking. Yes, it sounds very serious and accusatory, but that leads to the next problem. They noticed that some of your transactions were abnormal. A charge letter, pursuant to 7 C.F.R. §278.6(b)…

Read About 10-Day Notice

Appeals

Appealing a decision by the USDA is of utmost importance when you receive a decision letter. Most of our clients depend on EBT for at least a significant portion of their gross revenues. The most common mistake that we see is when our client simply does not respond to the letter…

Read About Appeals

Applications

At some point, the USDA started monitoring your business for SNAP Trafficking. Yes, it sounds very serious and accusatory, but that leads to the next problem. They noticed that some of your transactions were abnormal. A charge letter, pursuant to 7 C.F.R. §278.6(b)…

Read About Applications

Nationwide Snap Defense Law Firm – Call (888) 577-1482